Tax Planning

Unlock significant tax savings and optimize your financial future. Our expert strategies can reduce your biggest expense and enhance asset growth over time.

Why Tax Planning is Essential

Taxes represent the largest financial burden for high-income earners, 1099 salespeople, and retirees. Without a solid tax planning strategy, you're likely overpaying and missing out on opportunities to grow your wealth. At Foxstone Financial, we understand the importance of minimizing your tax liabilities to ensure a more prosperous future. Our approach leverages the compounding effect of tax savings, allowing you to achieve significantly higher asset levels over time. Let us guide you through the complexities of tax planning and help you keep more of what you earn.

Tailored Tax-Saving Strategies

Our expertise in tax planning opens the door to a variety of strategies designed to maximize your savings and integrate seamlessly with your overall financial plan. Each strategy is carefully selected based on your unique financial situation, goals, and the potential to reduce your tax burden by 10% to 50% of Adjusted Gross Income. Our customized solutions for accredited investors includes:

Cash Balance Plans

Significant tax benefits, allowing for flexible, substantial retirement savings

Intangible Drilling Costs

Invest in oil and gas projects with immediate deductions

Sec 179 Equipment Leasing

Substantial tax deductions and flexibility in depreciating equipment costs

Green Energy Tax Credits

Earn credits for investing in sustainable energy solutions

Micro-Captive Insurance Companies

Create tax-efficient insurance options for business owners

Building Easements & Land Donations

Real Estate development with a charitable donation option

Personalized Planning

and Benefits

At Foxstone Financial, we believe in a personalized approach to tax planning. Understanding your individual circumstances allows us to recommend the most effective tax-saving strategies and benefits.

Significant Reduction in Taxable Income

Enhanced Asset Growth

Customized Financial Planning

Alternative Tax Strategies

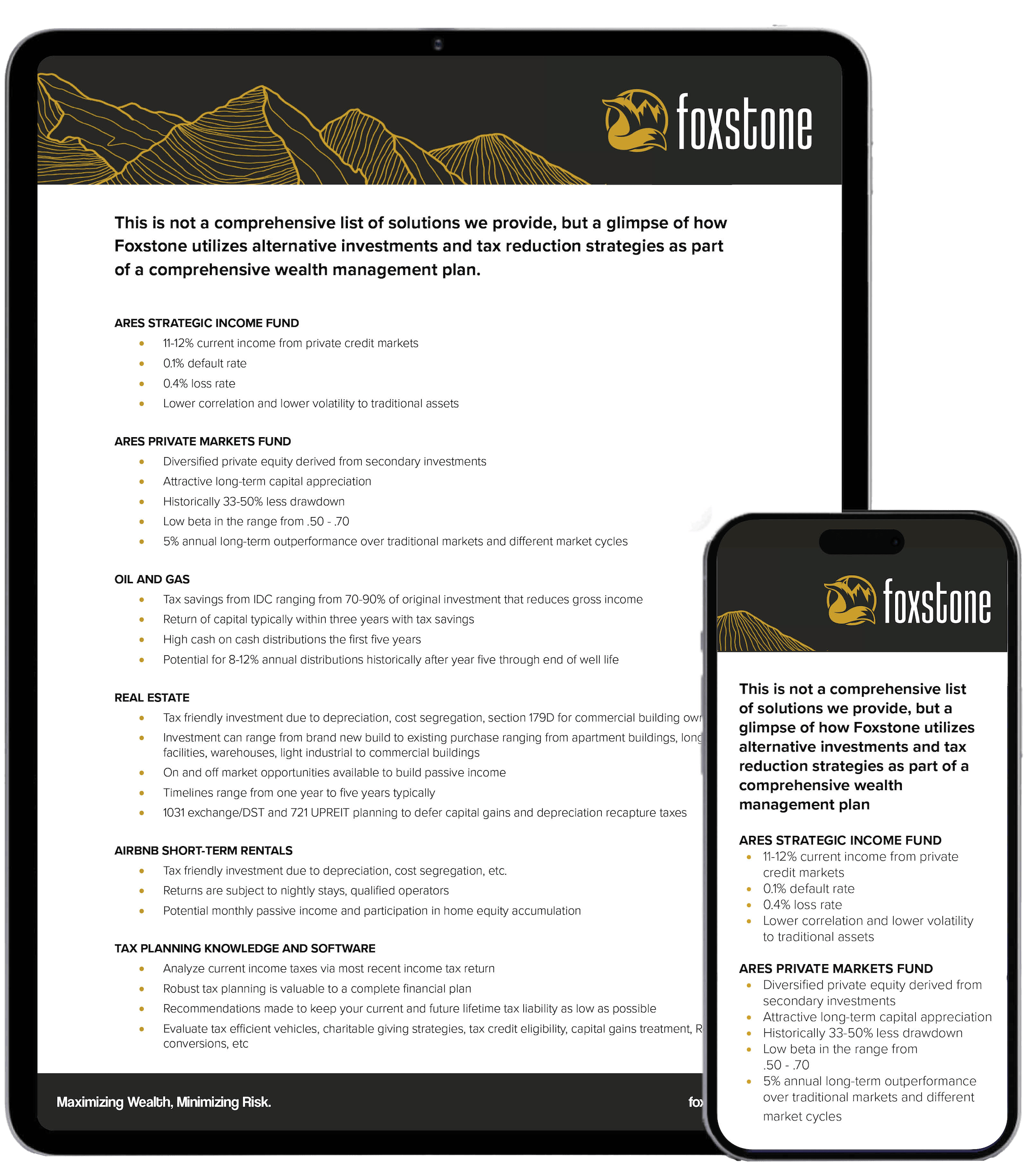

Discover how Foxstone Financial leverages alternative investments and tax reduction strategies to maximize wealth and minimize risk. This document provides insights into private equity, real estate, tax planning, and innovative investment opportunities like oil and gas, Airbnb rentals, and solar tax credits. Download now to explore comprehensive wealth management solutions tailored to optimize your financial future.

Maximize your savings and investment growth potential

Each client’s journey is unique, and we're here to navigate the complexities of tax planning together.